Depreciation formula math calculator

Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of SalvageCost 1Life Variable Declining Balance Depreciation Calculator. The second method is estimating the initial value of the car.

Pin By Pinner On Http Www Emenel Net Bookkeeping Services Cloud Accounting Document Storage

Determine the cost of the asset.

. Formula to Calculate Depreciation Expense. Also find Mathematics coaching class for various competitive exams and classes. A book value or depreciated value P principal amount i interest rate written as a decimal n time period in years.

It is determined by multiplying the book value of the asset by the straight-line methods rate of depreciation and 2 read more method to calculate the tanks depreciation expense. Depreciation Cost Formula 2 Rate of depreciation Book value of an asset or Depreciation Costs Formula 2 Asset cost - Accumulated depreciation Useful Life of the. All you need to do is.

Thus The formula as per the straight-line method. Calculate depreciation of an asset using the double declining balance method and create a depreciation schedule. Select the currency from the drop-down list optional Enter the purchase price of the vehicle.

Combined declining balance method and straight line method. Depreciation rate in percentage r. Enter the number of years you will own the car.

Non-ACRS Rules Introduces Basic Concepts of Depreciation. The diminishing value method DV This method depreciates at a high rate for the start of an. Divide the sum of step 2 by the number arrived at in step 3 to get.

Tanks have a useful life of 10 years and a scrap value of 11000-. To calculate the used cars value we need certain input variables that have been given below. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures.

When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. Again notice the similarity to the compound interest formula. The formula for depreciation goes like this.

Using the formula for simple decay and the observed pattern in the calculation above we obtain the following formula for compound decay. Calculate depreciation for any chosen range of periods and create a variable. Percentage Declining Balance Depreciation Calculator.

1useful life of asset 10. Formula for the double declining balance method is 2 X Cost of the asset Depreciation rate. Balance Formula with Double Declining 2 X Cost of the assetUseful Life.

Depreciation - Math Formulas - Mathematics Formulas - Basic Math Formulas Javascript is disabled in your browser. The depreciation amount will be as follows. Initial Cost C.

Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount. Lets assume you were looking to buy a three-year-old car for 12000. It is fairly simple to use.

A C times 1 fracrn100 Advantages of Using the Car Depreciation Calculator. Determine the useful life of the asset. The straight line calculation steps are.

It is a non-cash expense forming part of profit and loss statements. 4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Math Pictures Credit Education. The formula of Depreciation Expense is used to find how much asset value can be deducted as an expense through the income statement.

Input the current age of the vehicle - if the car is new simply input 0. This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods. How to Calculate Straight Line Depreciation.

A P1 in. Number of years car used n. Double Declining Balance Method.

You can now compare it to the price of a brand new car. For example if you have an asset that has a total worth of 10000 and it has a depreciation of 10 per year then at the end of the first year the total worth of the asset is 9000. This online accounting calculator is used to find how much value of the asset can be deducted as an expense through the income statement.

The calculator allows you to use Straight Line Method Declining Balance Method Sum of the Years Digits Method and Reducing Balance Method to calculate depreciation expense. The calculator also estimates the first year and the total vehicle depreciation. If you input the value into the 3 years box the car depreciation calculator will display the cars initial value in this case over 20500.

Depreciation may be defined as the decrease in the assets value due to wear and tear over time.

Journal Entry For Depreciation Accounting Notes Accounting Principles Journal Entries

Earnings Before Interest Tax Depreciation And Amortization Ebitda Defination Example Financial Statement Analysis Financial Statement Income Statement

Accounting And Finance Ppt Bec Doms Bagalkot Mba Finance Accounting And Finance Economics Lessons Accounting

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Asset Calculator

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

How To Calculate Book Value 13 Steps With Pictures Wikihow Economics Lessons Book Value Books

Exponential Functions Ti Nspire Car Depreciation Project

How To Calculate Depreciation On Fixed Assets Fixed Asset Math Pictures Economics Lessons

Depreciation Journal Entry Step By Step Examples Journal Entries Accounting Basics Accounting And Finance

Pin On Manuals

Entrepreneurship Infographics Napkin Finance Financial Statement Financial Literacy Lessons Accounting And Finance

Pin On Physics Maths

Women Who Invest In Themselves Go Further Portiasavings Thepowerofinvestingyoung Compoundinterests Compoundintereston Investing Compound Interest Portia

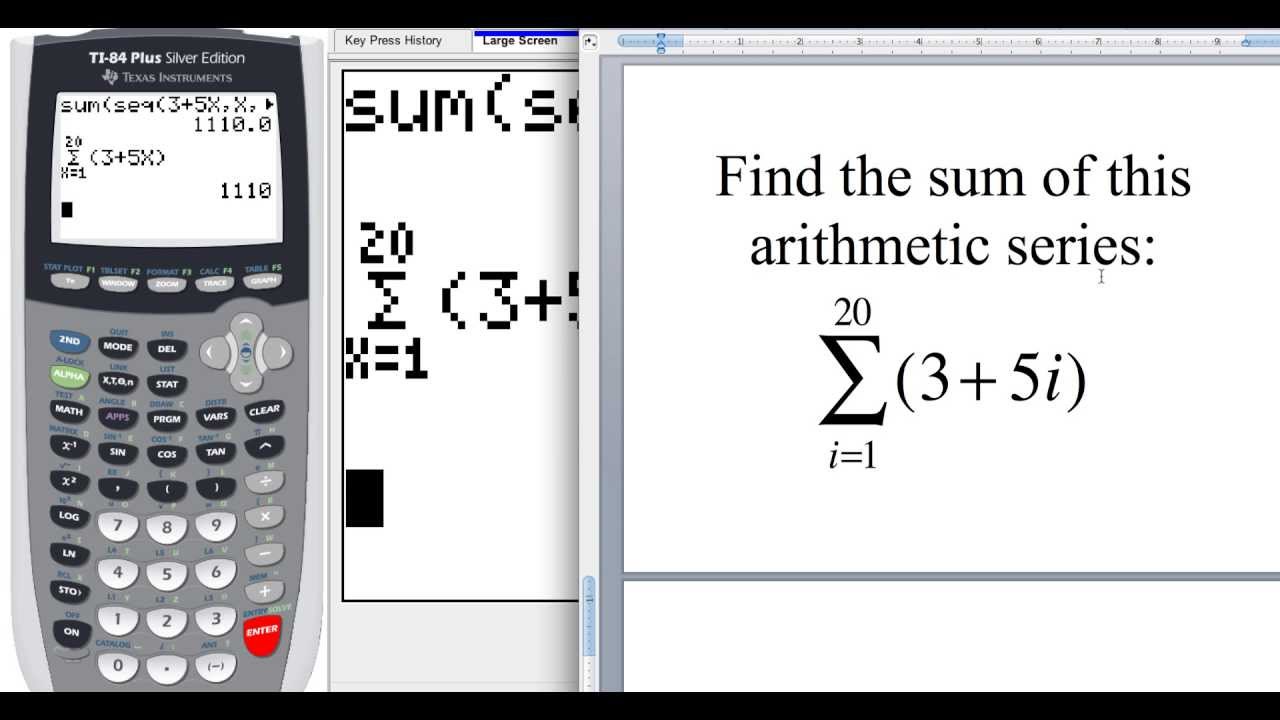

12 2 How To Find The Sum Of An Arithmetic Sequence On The Ti 84 Precalculus Graphing Calculators Arithmetic

Finance Investing Accounting And Finance Finance

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Math Pictures Credit Education

Finance Investing Accounting And Finance Finance